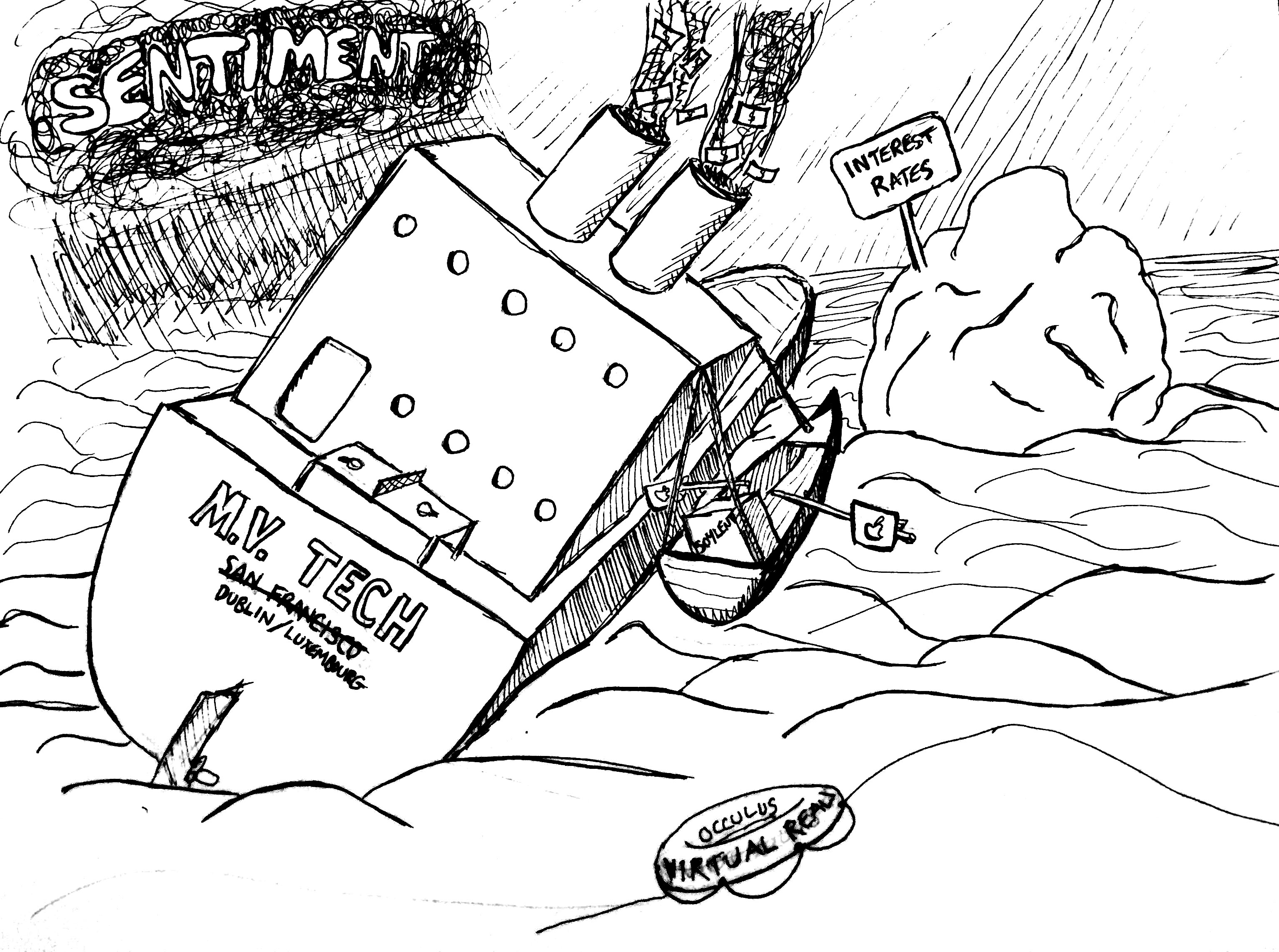

The impending tech slowdown

There’s been talk of a bubble for at least two years, and so far there’s little sign of it bursting (or perhaps even existing). That said, it feels like a few unrelated circumstances are aligning and some sort of downturn this year is now likely.

Public market sentiment

Almost every startup that floated in the past two years is massively down on its IPO price.

Union Square Ventures’ is one of the best regarded funds. Their entire post-IPO portfolio is down over 50%. This worries me.

- Etsy is down 75% from its float price,

- Twitter is down 50%.

- Zynga is down 75% from float.

- Lending Club is down nearly 80% from float.

And Andreessen Horowitz:

- Box. Down 65%

- Groupon. Down almost 90% from float. (although it traded this low in late 2012 before recovering somewhat).

Kleiner Perkins:

- Square. Down 17% from IPO two months ago. Not as bad as I expected.

- Teladoc. Down 40% from float.

- Invuity. Down 50% from floating less than a year ago.

- Chegg. Down 30%

(I’ve skipped quite a few for Kleiner Perkins because I’d never heard of them…so this might not be representative)

Others recently IPOed:

- Shopify. Down 30%.

- Atlassian. Marginally down 10% on its float last month.

- GoPro. Down 70% from float.

- Fitbit. Down 48% from float.

- New Relic. Performing (relatively) well, down around 12% after a stable year on the market.

Having actually researched these prices it’s clearly a bloodbath at the moment. No-one is heading into the public markets in these conditions. An investor looking at these numbers and comparing them with late-stage private market valuations is going to suspect that VCs have been offloading turds while hanging onto the diamonds. I doubt this is the case.

Interest rates are rising

Large amounts of capital have been put into tech startups during this recent period of near-zero interest rates. This is obvious and easily measured for late-stage private companies - those which would, in a normal environment, be pushed into the public markets by the amount of capital they need.

Now that rates are moving upwards this capital will likely dry up - and very quickly if sentiment turns against techs.

At the same time I believe a larger effect has been from the smaller amounts of seed-stage capital deployed into total dead-end ideas (basically 75% of Product Hunt’s front page), tying up anything from one to ten people, and increasing competition for talent. It’s at this end of the market that funding will disappear the quickest and have the most immediate effect. These companies generate zero revenue and have no cushion or scope for downsizing.

Paul Graham has stepped away from YC, the industry’s flagship incubator, and I think this might represent their high-watermark for a few years. But equally the reduction in early-stage funding may return to a situation where startups seek out YC because they need the money, and not because of the prestige and network. I think a lot of lower tier YC-clones will close or hibernate for a while.

Mobile is mature

The mobile operating systems are now clearly either Android or iOS. Blackberry, HP, and Samsung are dead on the software side.

The goldrush on app development is coming to an end. 10 of the 12 top mobile apps in the US are owned by Apple, Facebook and Google.

Gaming on mobile has failed to move beyond ephemeral puzzlers with a simple game mechanic - time-wasters rather than immersive experiences. In-app purchases are widely recognised for the poor value they offer. There will continue to be break-out successes but a lot of the money that flowed into app development, and into marketing and monetizing those apps, will evaporate. Small companies will shut down, large companies will take their write-offs and close divisions. The slack will not be taken up by VR immediately.

Advertising

Anecdotally I see a small drop in CPM rates for adspace on my own properties. Adblocking might become more mainstream. Big publishers with high costs are being greedy with display advertising and pissing off their audiences. I suspect we might see a viscious circle come into play where ad revenue drops, leading to more audacious popups, leading to more ad blocking.

There are also theories that considerable advertising spend is from startups advertising on other startups, and that this pyramid type situation will collapse. The most aggressive advertisers in the sector (Rackspace, Media Temple, InVision and New Relic for example) will all see material drops in their businesses and consequent reductions in spend. None of them is a profit powerhouse (to my knowledge).

Costs

The costs of technology and servers are at rock bottom (effectively zero if managed correctly). But the costs of staff are beyond absurd. Office space and hotels in San Francisco are at record levels - the highest in the US.

The good news

Awesome things are still being built and I think a slowdown is going to trim some fat off the industry. If anything it will increase innovation and we’ll see the huge numbers of bullshitters go back to peddling timeshares or spreadbets. Good startups should hopefully be more recogniseable.

I hope any downturn will free up talent from working on crap, and lower the costs of building products. The fully-loaded cost of a good developer is an absolute minimum of $100k per year in most places in the world now (cheap offshore talent is a myth in my experience.)

Apple, Google, Amazon and particularly Facebook, continue to outperform and I think they might be strong buys if they are pulled down by the rest of the market.

I predict huge growth from Facebook. Their advertising business is still in its infancy. They are attracting top developer talent, and their reputation is strong both among developers and the general public. Facebook have made very few mistakes over their ten years - Facebook Credits and Gifts are two that come to mind. These are petty cash compared to Google - Glass, Hotpot, Wave, Plus, Motorola, those barges…

Some strong companies might come into the public markets this year - Dropbox, Airbnb, Uber. This is probably the make-or-break situation - if they are well-received and sensibly priced then things could go well. But Uber in particular needs capital to sustain itself and may be forced into the market.

Virtual reality might be the next big thing. I don’t know. It will probably be a big thing for a few years and take the pressure off the collapse in mobile apps.

So that’s the end of my rambling thoughts with no real conclusion. I’m far from gloomy.

I own a small amount of stock in Facebook and Twitter.